In 2026, financial experts and savers are paying close attention to the impact of rising interest rates on savings and investment strategies.

With many banks offering high-yield savings accounts and certificates of deposit (CDs) yielding annual percentage yields (APY) between 4.5% and 5%, compound interest has become a critical tool for building wealth efficiently. This environment presents both opportunities and challenges for individuals aiming to optimize their financial growth.

Understanding how compound interest functions and leveraging high interest rates can significantly influence long-term financial outcomes. As central banks adjust monetary policy, and interest rates fluctuate, savers and investors must adapt their strategies to maximize returns while managing risk effectively. Below, Investment Ideas For Beginners will discuss further.

How High Interest Rates Amplify Compound Interest

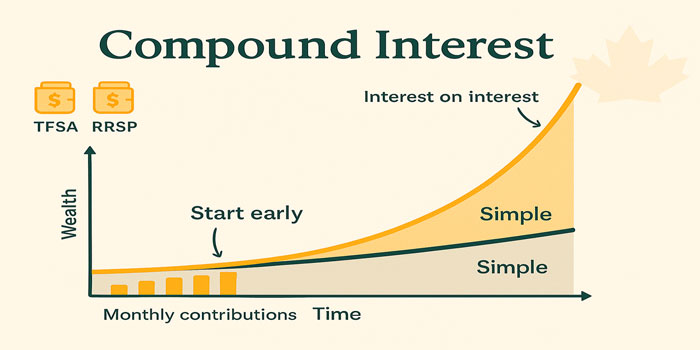

Compound interest works by earning interest not only on the principal amount deposited but also on the accumulated interest from previous periods. When interest rates rise, the effect of compounding becomes even more pronounced, leading to faster growth of savings over time.

The Mechanics of Compound Growth

For example, if an individual deposits $10,000 into a high-yield savings account with a 5% APY compounded monthly, the balance will grow more quickly than with a lower interest rate. The monthly compounding ensures that each month’s interest contributes to the principal, generating additional interest in subsequent months. Over a period of several years, this exponential growth can substantially enhance wealth, even without additional contributions.

High interest rates increase the APY applied to the principal and previously earned interest, making compound interest more effective as a wealth-building tool. Savers who capitalize on this environment can achieve their financial goals faster than in periods of low interest rates.

Strategic Timing And Locking In Rates

Timing is essential when leveraging high interest rates. Savers can choose fixed-term instruments such as CDs to lock in rates for extended periods. This approach protects against potential future rate declines and ensures that compounding continues at a favorable rate. However, it also requires careful planning, as premature withdrawals from such accounts may incur penalties that reduce overall returns.

Individuals who monitor rate trends and strategically allocate funds to high-yield accounts or CDs can maximize the benefits of compounding in the current high-interest-rate environment.

Also Read: Stock Investment for Secure Finances

Applications Of Compound Interest In Personal Finance

Compound interest is not limited to savings accounts and CDs. It is a foundational principle in personal finance and can be applied across various investment vehicles.

Retirement Planning And Long-Term Growth

One of the most impactful uses of compound interest is in retirement planning. Contributing regularly to retirement accounts such as 401(k)s, IRAs, or other tax-advantaged accounts allows savers to benefit from compounding over decades. High-interest savings options or investment vehicles with reliable growth further amplify the compounding effect, providing a more secure retirement outcome.

Early contributions are particularly valuable because the more extended the compounding period, the greater the growth potential. Even modest monthly contributions can accumulate substantial wealth over time, thanks to the exponential nature of compound interest.

Short-Term Goals And Emergency Funds

While compound interest is often associated with long-term growth, it is also effective for short-term financial goals. High-yield savings accounts and CDs provide safe, interest-bearing options for emergency funds, vacation savings, or down payments on large purchases. By selecting accounts that offer competitive APYs, individuals can ensure that their funds not only remain accessible but also grow steadily.

Reinvestment Strategies

Reinvesting interest and dividends is another way to harness the power of compound interest. For example, in investment portfolios, automatically reinvesting dividends or interest payments allows the compounding process to continue uninterrupted. Over time, this strategy can result in significantly higher returns compared to accounts where interest is withdrawn regularly.

Challenges And Considerations

Although high interest rates enhance the effects of compound interest, there are potential challenges to consider. Inflation can erode the real value of returns if rates do not keep pace. Additionally, individuals must remain aware of account fees, withdrawal penalties, and market fluctuations that may impact overall returns.

Risk management and careful account selection are critical to ensuring that the compounding advantage is not offset by unexpected costs or losses. Financial advisors often recommend a diversified approach that balances safe, interest-bearing accounts with moderate-risk investment opportunities.