Investing is an important financial strategy for building long-term prosperity with the right approach your funds can grow optimally.

And help achieve various financial goals. Smart investing not only focuses on potential returns but also considers risk, planning, and discipline in asset management. Through a sound understanding, investing can be an effective tool for putting money to work productively. Check out the complete facts about Smart Investment, only at Investment Ideas For Beginners.

Understanding Basic Investment Concepts

Investing is the process of placing funds in certain instruments with the expectation of future returns. These returns can be in the form of increased asset value, passive income, or a combination of both. Unlike saving, investing offers the potential for higher returns, but also carries risks.

A basic understanding of the relationship between risk and return is crucial. Instruments with high potential returns typically carry a higher level of risk. Therefore, understanding your risk profile is a foundational foundation before starting to invest. Your risk profile is influenced by your financial goals, investment horizon, and tolerance for asset value fluctuations.

Furthermore, the concept of the time value of money plays a crucial role. Funds invested early have a greater opportunity to grow through the effects of compound interest. With consistency and sufficient time, asset growth can be significant.

Determining Goals and Financial Planning

Effective investing always begins with a clear goal. Financial goals can include preparing for retirement, education, purchasing assets, or protecting wealth from inflation. Specific goals help determine the most appropriate investment instruments and strategies.

Financial planning serves as a roadmap for managing cash flow, expenses, and the allocation of investment funds. With thorough planning, investments can be structured without disrupting daily needs. Discipline in following the plan is key to long-term success.

Furthermore, an emergency fund should be prepared before starting to invest. This fund serves as a financial buffer in the event of unexpected circumstances, preventing investments from being liquidated at an inopportune time.

Read Also: Beginner-Friendly Investments That Beat Inflation In 2026

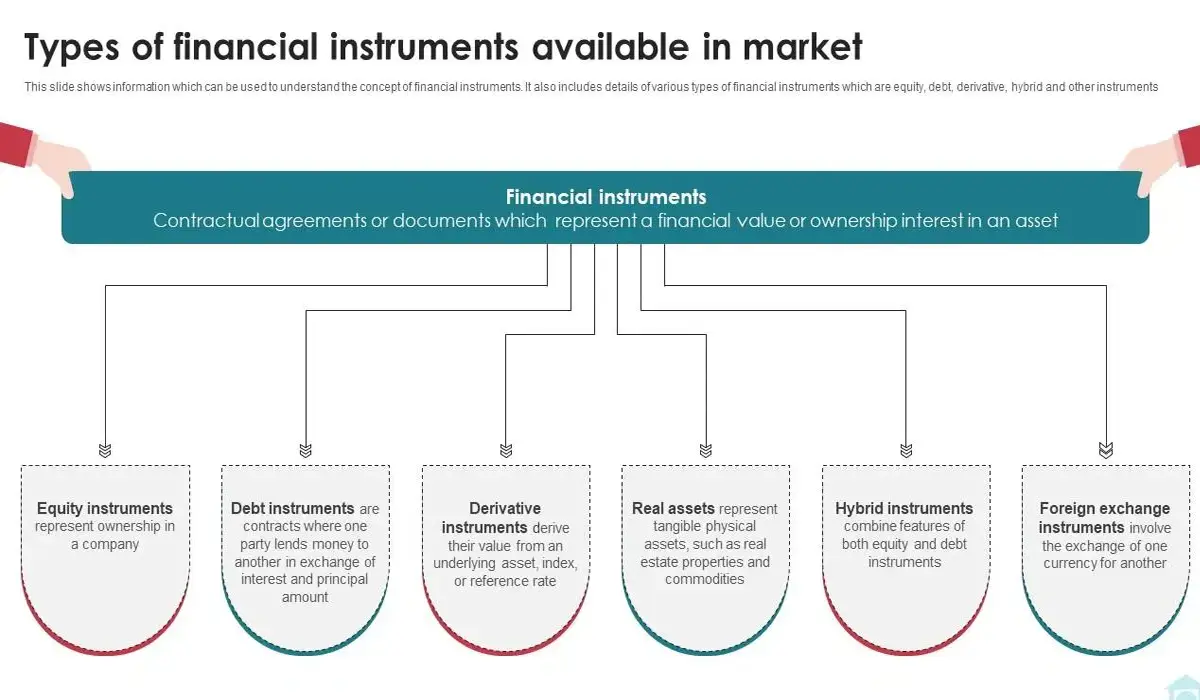

Understanding Various Investment Instruments

A variety of investment instruments are available with varying characteristics. Stocks offer the potential for high long-term growth, but they can fluctuate significantly. Bonds tend to provide more stable returns with lower risk than stocks. Mutual funds are an alternative for those seeking instant diversification.

These professionally managed funds allow investments in various assets simultaneously, thus spreading risk. Additionally, instruments such as gold and property are often used as hedges against inflation. The choice of investment instrument should be tailored to your goals and time horizon. For short-term goals, more stable instruments may be an option, while for long-term goals, instruments with higher growth potential can be utilized.

Diversification Strategy to Manage Risk

Diversification is an important strategy in smart investing. By spreading funds across various instruments or sectors, the risk of loss can be minimized. When one asset declines, another asset has the potential to perform better. Diversification is not limited to the type of instrument but also encompasses industry sectors and geographic regions.

This approach helps maintain portfolio stability in various economic conditions. Periodic portfolio adjustments are also necessary to maintain alignment with financial goals. In addition to diversification, consistency in investing has a positive impact. Periodic investing allows the purchase of assets at various price levels, thus better managing volatility risk.

Discipline and Evaluation in Long-Term Investing

Discipline is a determining factor in investment success. Market fluctuations often trigger emotional decisions that can be detrimental. With discipline, planned strategies can be implemented consistently without being affected by short-term fluctuations.

Regular evaluation of investment performance is also crucial. This evaluation ensures the portfolio remains aligned with your goals and risk profile. If changes occur in your financial condition or life goals, strategy adjustments can be made in a planned manner. Improved financial literacy also supports better investment decisions. By continuously learning and keeping up with economic developments, decisions will be more rational and informed. Thank you for taking the time to find out interesting information about Smart Investment in Investment Ideas For Beginners, we will provide lots of other information.

Image Information Source:

First Image: sarasotamagazine.com

Second Image: slidegeeks.com