Investing in the share market can be a profitable way to build wealth over time, but it comes with its fair share of risks.

Understanding both the rewards and risks, as well as the strategies to minimize losses and maximize gains, is crucial for anyone looking to invest in stocks. This article on Investment Ideas For Beginners outlines the key aspects of stock market investing, helping investors make informed decisions.

Understanding the Risks of Share Market Investment

While the potential for high returns is one of the main attractions of the stock market, the risks are undeniable. Stock prices are highly volatile and can fluctuate due to factors such as economic conditions, political events, or changes in market sentiment. A stock that performs well today could fall sharply tomorrow due to unforeseen circumstances.

Market risk, also known as systemic risk, affects all stocks to some degree, and investors cannot avoid it entirely. Even a diversified portfolio cannot shield investors from significant downturns like those caused by market-wide crashes or economic recessions. It is important to recognize that investing in the stock market requires the willingness to accept these risks, as gains and losses can be unpredictable in the short term.

Another type of risk is company-specific risk, which is associated with individual companies. If a company faces management issues, regulatory hurdles, or product failures, its stock price can plummet, regardless of broader market conditions. This risk can be mitigated by conducting thorough research into a company’s financial health, competitive advantages, and leadership before investing.

The Rewards of Investing in Stocks

The rewards of investing in the stock market are enticing. Historically, stocks have outperformed other investment types, such as bonds and savings accounts, in terms of long-term returns. Over time, stock prices generally appreciate in value, driven by factors like company growth, innovation, and increasing demand for products or services.

Dividends also offer a steady income stream for shareholders. Some companies distribute a portion of their profits as dividends, providing investors with passive income while holding the stock. This can be especially appealing for long-term investors looking to create a source of income in addition to capital gains.

Moreover, the power of compound growth in the stock market can significantly increase an investor’s wealth. Reinvesting dividends and holding onto stocks for the long term can result in exponential growth over time. The earlier you start investing, the more you can benefit from this compounding effect.

Also Read: From Zero to Investor: Investment Ideas for Beginners

Key Strategies for Successful Share Market Investment

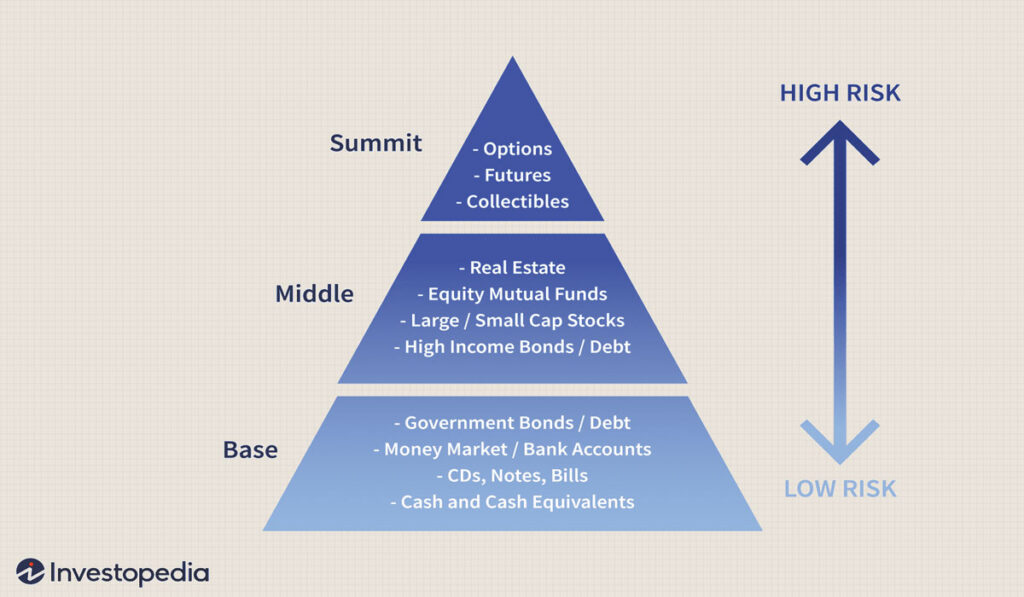

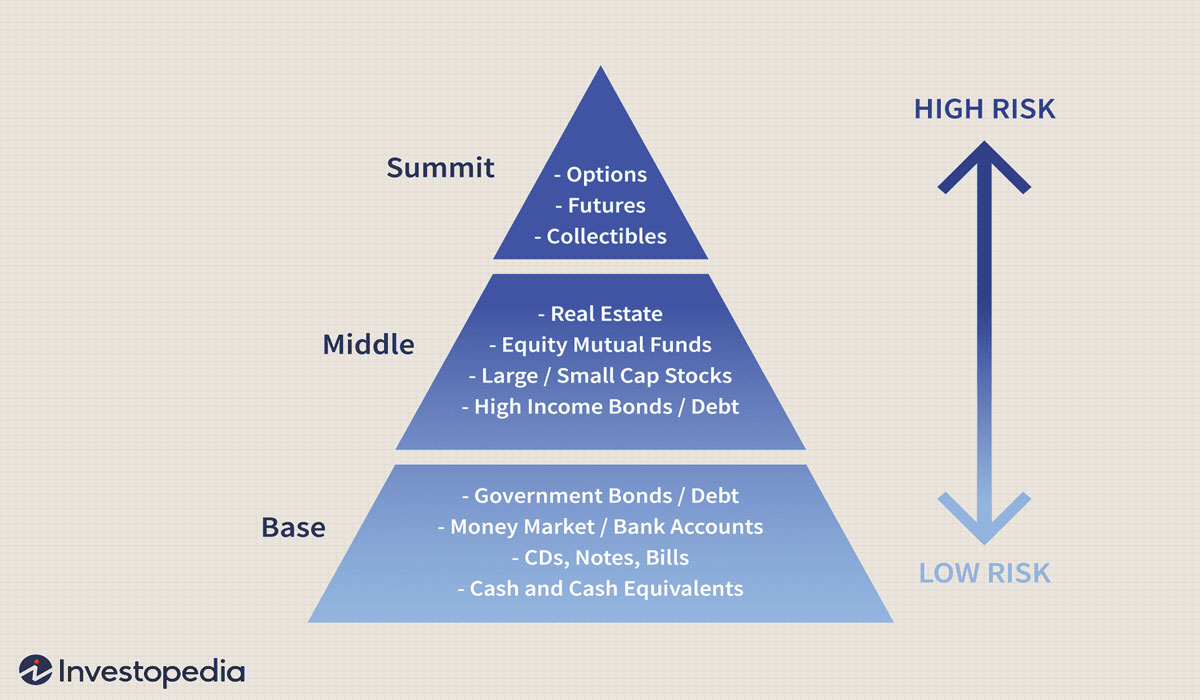

To navigate the complexities of the stock market, investors must adopt well-thought-out strategies. One of the most important strategies is diversification. Spreading investments across different sectors, industries, and geographic regions can help reduce the impact of a single company’s poor performance on the entire portfolio. This strategy limits exposure to any one risk and increases the chances of overall portfolio growth.

Another effective strategy is dollar-cost averaging (DCA), where an investor invests a fixed amount of money at regular intervals, regardless of market conditions. This approach reduces the impact of short-term market fluctuations and allows investors to buy more shares when prices are low and fewer shares when prices are high, thus averaging the cost of their investments over time.

For those who prefer a more passive approach, index funds or exchange-traded funds (ETFs) are great options. These funds track a broad market index like the S&P 500 and provide exposure to a wide range of stocks with lower fees and reduced risk compared to investing in individual stocks.

Conclusion

Investing in the share market can be highly rewarding, but it is not without its risks. To succeed, investors must strike a balance between managing those risks and maximizing potential rewards. Understanding the volatility of the stock market, diversifying investments, and employing sound strategies such as dollar-cost averaging can help investors navigate this dynamic environment.

With patience, knowledge, and discipline, the share market can be a powerful tool for wealth creation and financial security. Thank you very much for reading this article about Investment Ideas For Beginners. If you are interested in the information we have provided, please contact us immediately. Once again, we thank you for your time in reading the information we have presented.

Image Source

First Imange: investopedia.com

Second Image: quantifiedstrategies.com