Discover how to invest in gold wisely as a beginner. Learn about physical gold, ETFs, and mining stocks, set a clear budget, and implement safe strategies.

Understand market trends, risks, and diversification to protect your wealth. This guide provides practical tips on maximizing returns while minimizing risks, helping you make informed decisions and achieve long-term financial security.

Below we will discuss how to invest for beginners only at Investment Ideas For Beginners

Understanding Gold as an Investment

Gold has been a trusted store of value for centuries, making it an attractive investment option. Unlike stocks or bonds, gold retains value even during economic instability. Beginners should understand that gold can act as a hedge against inflation, currency fluctuations, and financial crises.

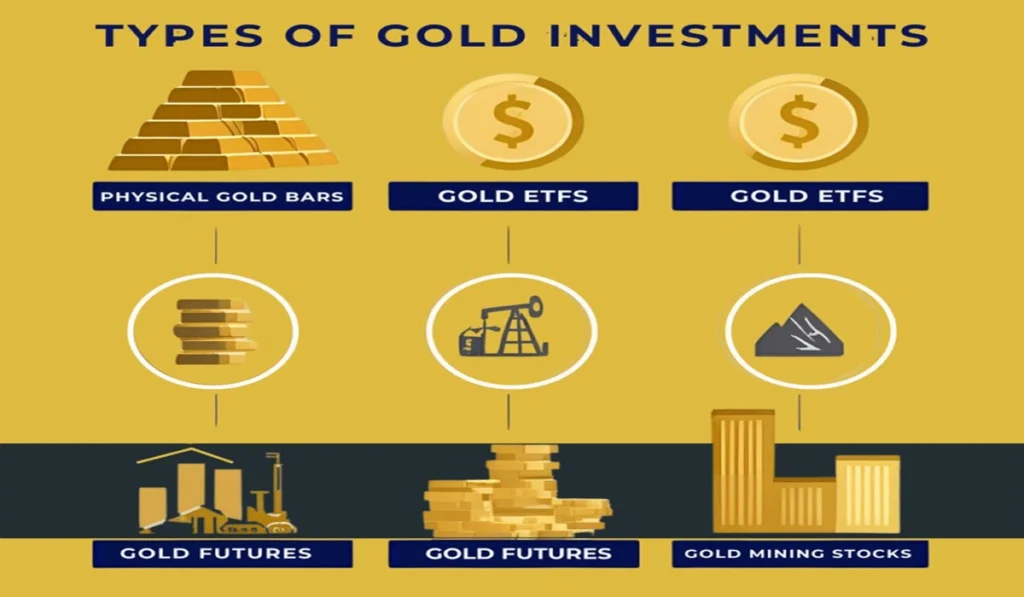

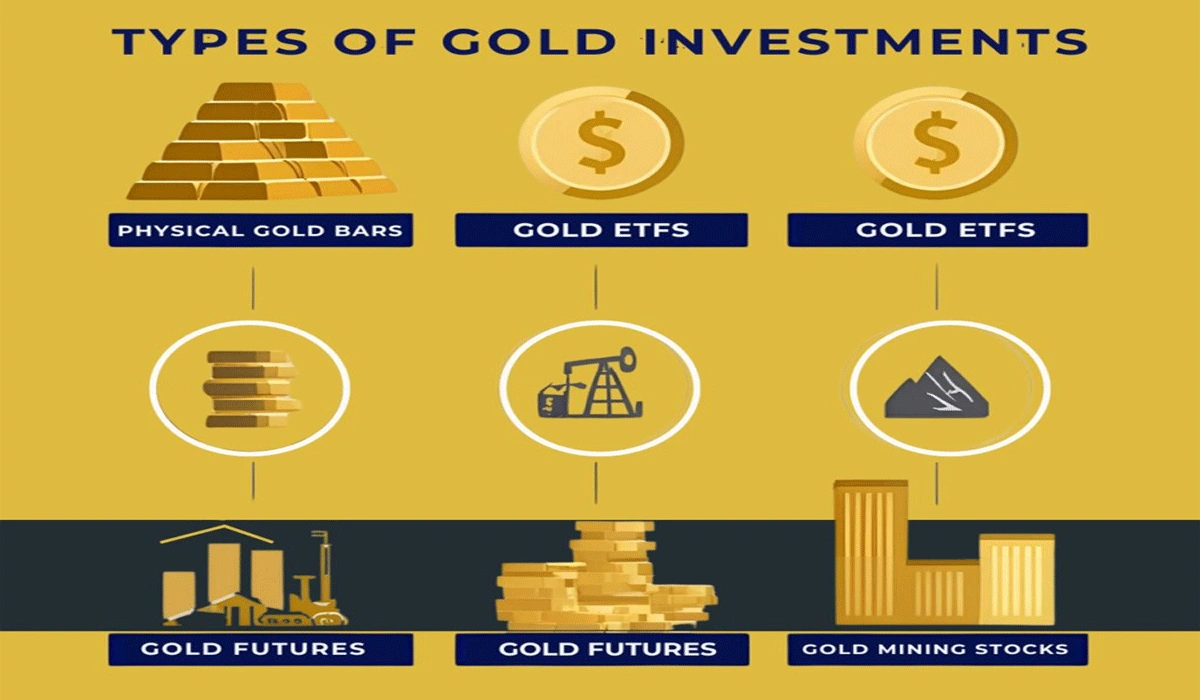

Investing in gold is not just about buying physical bullion; it also includes options like ETFs, gold mining stocks, and digital gold. Each option comes with unique benefits and risks, so it is essential to choose one that aligns with your financial goals. Understanding these choices allows beginners to make informed decisions.

Gold investment requires patience and a long-term perspective. Its price may fluctuate in the short term, but historically, gold has consistently held its value. By educating yourself about gold’s market trends, you can minimize risks and maximize potential gains over time.

Choosing the Right Type of Gold Investment

Physical gold, such as coins and bars, is the most straightforward option. It offers tangible ownership but requires safe storage and insurance. Investors must also consider buying from reputable dealers to avoid counterfeit products. Handling costs, storage fees, and liquidity are factors to evaluate when investing in physical gold.

Gold ETFs provide a convenient alternative, allowing you to invest without storing physical gold. These funds track gold prices, offering liquidity and easier portfolio management. For beginners, ETFs can reduce the risks associated with handling physical gold while still gaining exposure to price movements.

Gold mining stocks and mutual funds are another option. They offer the potential for higher returns but carry more market risk. Beginners should research the mining company’s financial health, production capacity, and market position before investing.

Setting a Budget and Investment Strategy

Before investing in gold, it is essential to set a clear budget. Only allocate a portion of your savings to gold to avoid overexposure. Understanding your risk tolerance and financial goals helps determine how much to invest and which type of gold to choose.

Beginners should also decide on their investment strategy, whether it is a lump-sum purchase or a regular periodic investment. Dollar-cost averaging allows investors to reduce the impact of price fluctuations. Developing a disciplined approach prevents impulsive decisions during market volatility.

Monitoring the market regularly is vital for any investment strategy. Keep track of gold price trends, economic indicators, and geopolitical events that could impact gold’s value. A well-informed strategy helps you make timely decisions and protects your investment over the long term.

Risks and Best Practices for Beginners

Like any investment, gold comes with risks. Price volatility, storage issues, and potential scams are concerns beginners must address. Physical gold requires security measures, while financial products carry market-related risks.

Diversifying your portfolio reduces risk exposure. Combining gold with stocks, bonds, or real estate can balance returns and protect against downturns in any single market. Beginners should avoid putting all savings into gold to maintain a balanced investment approach.

Consulting financial advisors or investment professionals can guide beginners in making smarter decisions. They can provide insights into market trends, investment options, and risk management strategies.

Take your time to read investment insights that are only available on Investment Ideas For Beginners.

Image Source:

- First Image from smart.dhgate.com

- Second Image from www.treasury.id