Investment can feel intimidating for beginners, especially if you are starting with zero experience.

The good news is that with the right guidance and simple strategies, anyone can begin their journey toward financial growth. In this article, Investment Ideas For Beginners will introduce beginner-friendly investment ideas, explain key principles, and help you take your first steps toward building wealth.

Understanding the Basics of Investing

Before diving into specific investment ideas, it’s crucial to understand the fundamentals. Investing is essentially putting your money to work to generate more money over time. Unlike saving, which typically earns minimal interest, investing carries some risk but offers higher potential returns.

For beginners, the first step is to educate yourself about different investment options, risk tolerance, and time horizons. Risk tolerance refers to your comfort level with fluctuations in your investment value, while time horizon is how long you plan to invest before needing access to your funds. Knowing these will guide your investment choices and help you stay consistent even during market ups and downs.

Investment Ideas for Beginners

Once you understand the basics, you can explore beginner-friendly investment options. Here are some ideas:

- Stock Market Index Funds: These funds track the performance of a market index like the S&P 500. They are ideal for beginners because they provide diversification and reduce the risk associated with investing in individual stocks.

- Exchange-Traded Funds (ETFs): ETFs work like mutual funds but trade on stock exchanges. They are affordable, easy to manage, and provide exposure to various industries, including technology, healthcare, and energy.

- High-Interest Savings Accounts and Certificates of Deposit (CDs): For very conservative beginners, these options provide low risk and modest returns. While not as profitable as stocks, they are safer and can be part of your investment foundation.

- Robo-Advisors: Platforms like Betterment or Wealthfront automatically manage investments for you based on your risk profile. They are beginner-friendly and require minimal effort.

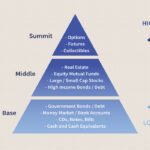

Building a Diversified Portfolio

Diversification is one of the most important principles of investing. It means spreading your money across different asset types to reduce risk. For example, combining stocks, bonds, and real estate investments can protect you from market volatility.

A beginner-friendly approach is to allocate a portion of your money to a broad stock market index fund, another portion to bonds, and a smaller portion to more stable assets like high-yield savings accounts or CDs. Over time, you can gradually explore other investment opportunities, such as individual stocks, real estate, or cryptocurrencies, depending on your risk tolerance.

Also Read: Mastering the Income Statement, A Beginner’s Guide To Smart Investing

Tips for New Investors

Starting from zero can be overwhelming, but following these practical tips will make your investment journey smoother:

- Set Clear Goals: Determine why you are investing whether it’s for retirement, buying a house, or building wealth. Clear goals will guide your strategy.

- Start Small: You don’t need a large sum to begin. Many apps allow you to invest with as little as $5.

- Stay Consistent: Regular, consistent contributions monthly or quarterly can lead to significant growth over time.

- Educate Yourself Continuously: Read books, follow financial news, and consider online courses to improve your knowledge.

- Avoid Emotional Decisions: Markets fluctuate, and it’s normal to see your portfolio go up and down. Stick to your plan and avoid panic selling.

- Leverage Tax-Advantaged Accounts: Accounts like IRAs and 401(k)s in the U.S. provide tax benefits and are excellent tools for long-term investing.

Conclusion

Investing doesn’t require you to be an expert or have a fortune to start. By understanding the basics, exploring beginner-friendly investment options, and following sound strategies, you can move from zero to investor with confidence. Remember, the key is consistency, education, and patience. Every small step you take today can lead to significant financial growth in the future.

visit our website for next level information in Investment Ideas For Beginners

Image Source

First Imange: telegraphindia.com

Second Image: corporatefinanceinstitute.com