Learn the complete steps for investing in shares on the IHSG, from understanding the index, selecting stocks, to basic strategies.

With this guide, novice investors can plan their portfolios, maximize profits, and make smarter, more informed investment decisions. The following Investment Ideas For Beginners will discuss the complete method of investing in shares in the IHSG, starting from the basics, the purchasing process, analysis tips, to profit-making strategies.

Basics of Stock Investment in the IHSG

Shares are securities that represent ownership in a company, and shareholders are entitled to dividends and profits from rising share prices.

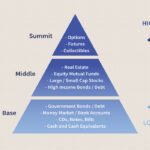

Investing in shares carries a higher risk than instruments like deposits, but also has the potential to provide greater returns. Therefore, it is important to understand the characteristics of shares and develop a sound risk management strategy to be prepared for fluctuations in share prices.

Furthermore, the Jakarta Composite Index (JCI) stock market operates every weekday with specific trading hours, and transactions are conducted online through securities applications supervised by the Financial Services Authority (OJK).

Steps to Buying Stocks on the Jakarta Composite Index

To start investing in stocks, the first step is to open a stock account with a securities company. Choose a reputable securities company that offers comprehensive services and competitive transaction fees. After opening an account, investors need to deposit funds to purchase shares.

Once the funds are available, investors can begin selecting the stocks they wish to purchase. The options are diverse, ranging from large, mid-sized, and emerging companies. It’s important to conduct research and choose stocks that align with your risk profile and investment goals. Use the securities app’s features to view real-time stock prices and easily make purchases.

When making purchases, investors must also understand terms such as the bid price, the ask price, and the number of shares they wish to purchase. Stock transactions on the Jakarta Composite Index are transparent and fast, so investors need to understand this process to avoid purchasing errors. Always monitor and evaluate your portfolio regularly.

Read Also: Investing in the Share Market: Risks, Rewards, and Key Strategies

How to Analyze Stocks on the Jakarta Composite Index

Stock analysis is key to selecting stocks with the potential to generate profits. There are two basic approaches: fundamental analysis and technical analysis. Fundamental analysis focuses on a company’s financial condition, profit performance, dividends, management, and growth prospects.

Meanwhile, technical analysis focuses more on stock price movements and market transaction volume using charts and various indicators. This helps investors determine the best time to buy or sell shares. The combination of these two analyses generally provides a more complete picture and facilitates more informed decision-making.

Monitoring economic news and industry developments is also crucial to support this analysis. The latest information on market conditions, government policies, and global situations can significantly impact the JCI stock price.

Strategies for Gaining Profit from Stock Investments

Profit from stock investments can be achieved in two main ways capital gains and dividends. Capital gains occur when the price of purchased shares increases and is then sold at a higher price.

Dividends are the periodic distribution of company profits to shareholders. Understanding when to hold or sell shares is crucial for investment returns.

A popular investment strategy is buy and hold, which involves purchasing shares in a solid company and holding them long-term to profit from price increases and dividends. Alternatively, there are trading strategies that focus on short-term profits by capitalizing on stock price volatility.

Listen and continue to follow the interesting information that we provide every day, of course updated and reliable only at Investment Ideas For Beginners.

Image Source:

First Image from kompas.com

Second Image from marribal.com