Mastering smart personal finance is essential for building a stable, secure, and truly worry-free financial future today.

Without proper planning, expenses can easily exceed income, making long-term goals like buying a home, financing education, or securing a comfortable retirement difficult to achieve. Personal finance isn’t just about saving. This article, Investment Ideas For Beginners will create smart strategies that make your money work for you, today and in the future.

Creating a Realistic Budget

The first step in managing your finances is crafting a realistic budget. List all your monthly income and expenses, including essentials like rent, groceries, bills, and entertainment. A clear budget allows you to see where your money goes and adjust spending to ensure it doesn’t exceed your earnings.

A well-planned budget also helps prioritize financial goals. Allocating funds for savings, emergency funds, or investments should be non-negotiable each month. By following a disciplined budget, you gain control over your finances and avoid habits that could harm your long-term financial stability.

Additionally, tracking expenses regularly can highlight unnecessary spending patterns. Over time, you’ll learn where to cut back and optimize your budget. This insight makes financial planning less overwhelming and more actionable.

Saving with Purpose

Saving money without a clear goal often leads to impulsive spending. Define specific objectives, such as building an emergency fund, planning a vacation, or purchasing significant assets. Clear targets provide motivation and focus, making it easier to stay disciplined.

Automatic savings methods can also help. Setting up recurring transfers to a savings account ensures consistency and removes the temptation to spend funds meant for future goals. Over time, even small amounts accumulate into substantial savings.

Purpose-driven saving forms the foundation for financial security. By knowing exactly what you’re saving for, you can make smarter choices, avoid unnecessary spending, and achieve milestones faster.

Understanding Investments

Investing allows your money to grow faster than simply saving. Choose investment options that match your risk tolerance, from savings accounts and bonds to mutual funds and stocks. Understanding potential returns and risks is critical before committing funds.

Long-term strategy is key. Markets fluctuate, and patience is essential to avoid panic during downturns. Diversifying investments across different assets reduces risk and increases the chance of steady returns.

With smart investing, personal finances don’t just remain secure, they grow. By balancing risk and reward and maintaining a diversified portfolio, you can achieve financial goals more efficiently than through savings alone.

Read Also: How to Start Investing with Little Money and Big Ambitions

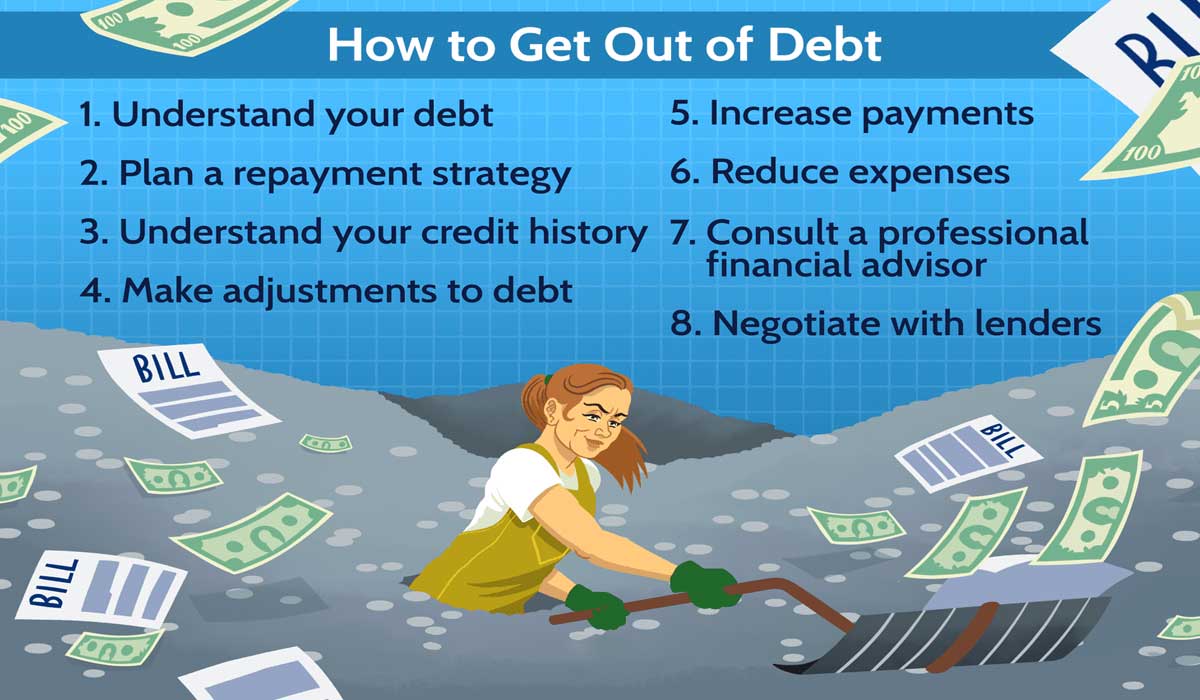

Managing Debt Wisely

Debt isn’t always harmful but must be managed carefully. Distinguish between productive debt, like education or business loans, and consumptive debt, such as credit card spending on non-essential items. Productive debt can create future opportunities, while consumptive debt burdens finances.

Always prioritize timely repayment, focusing on high-interest debts first. Avoid accumulating multiple loans or credit balances simultaneously, as this increases financial stress.

Wise debt management safeguards your financial health and ensures flexibility. Properly managed debt can even enhance credit scores and open opportunities for future investments.

Building an Emergency Fund

An emergency fund is essential for financial stability. Ideally, it should cover three to six months of living expenses to handle unexpected situations like job loss or medical emergencies. Without this safety net, emergencies can force borrowing or selling assets under pressure.

Keep your emergency savings in a separate, accessible, and secure account. This ensures funds are available when needed without risk of being spent impulsively.

A well-established emergency fund provides peace of mind and strengthens your long-term financial plan. Stay tuned Investment Ideas For Beginners it will act as a foundation for financial security, allowing you to pursue other goals with confidence.

Image Source:

- First Image mraadvisory.com

- Second Image investopedia.com